Apple is DOOMED, DOOMED, I tells you. Or perhaps not, if you have a modicum of sense…

Apple is DOOMED, DOOMED, I tells you. Or perhaps not, if you have a modicum of sense…

But I do think I’ve finally understood the last 18 months of Apple and how a company with such a tremendous level of revenue and profits can fall foul of bizarre expectations for growth and behaviour.

You would think a company with such a peerless brand, an era-defining line-up of profitable products and strong retail, media and app stores would get a bit of an easy ride. So why does anyone and everyone question the future of this company and demand the CEO stands down NOW?

My theory has nothing do with Samsung, a lack of innovation, Tim Cook or any of the crazy two bit theories peddled by combinations of analysts (often working for competing firms), tech journalists (who stretch the definition of both those words) and stock manipulators.

My theory is really to do with Steve Jobs. But NOT how you might think.

Since the launch of the iPhone and the iPad, Apple’s performance should, by all accounts, have set a consistent course for outer space. And it kind of did, for a while, but not when it should!

Taking Stock

Look at the stock price over 5 years.

WOW. Look at that growth and decline. But wait!

Steve Jobs died on October 5, 2011. (I’ve shaded in the period after that date). During the heady days of the launches of era-defining iPhone and iPads, and with the visionary Jobs at the helm, Apple saw a steady but unspectacular rise in the share price (after the 2008 financial crisis). Then TC takes over and BOOM.

Forgetful

But we seem to selectively remember and warp our technology history. “Apple released the iPhone, released the iPad and then took off… And then fell to the ground after Tim Cook’s tenure took hold”. Or so we’re led to believe.

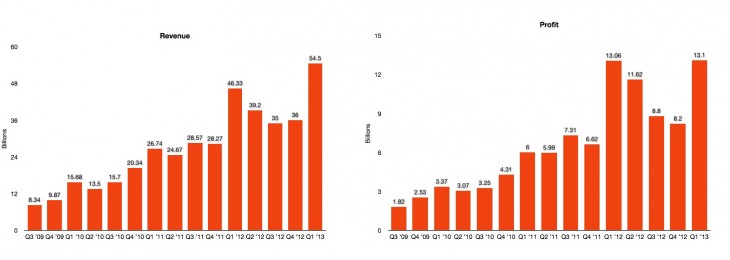

People forget the Steve Jobs era slow iPhone start; the modest targets; the iPad “disappointment“; the long delays, the staggered regional roll outs; the carrier lock-ins. But there is a “tipping point” event that may have confused onlookers. Look at Apple’s revenue and profits up until the 2012 holiday quarter (from The NextWeb)

Apple has always had plenty of seasonality (since the coming of the iPod) but Q1 2012 (that’s Oct-Dec 2011) looks different. Yikes… It pretty much doubled the revenue and profits from the previous holiday quarter. The publishing in January 2012 of these results is really when Apple shares took off.

Standby for Launch

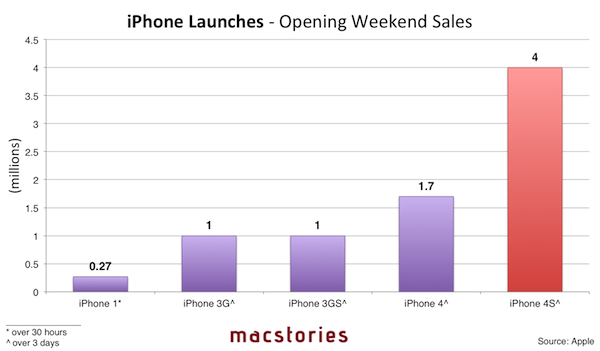

The iPhone 4S was launched on the 4th October 2011. Look at the iPhone launch weekend sales (thanks to Macstories)

Yep, it was the iPhone 4S took Apple to the moon in the 2011 holiday quarter!

The iPhone 5 managed to just about beat the 4S figures a year later, but not by much (4.5m sales) and they had to pull out ALL the stops to get the phone out worldwide in that launch quarter (including the vital Chinese market) in order to surpass the 4S.

Let’s take a closer look. The 4S was a strange beast. An internal rebuild to an existing shell that was released nearly 18 months after the iPhone 4 (the longest period ever seen between iPhone launches). It benefited from a tremendous level of pent-up demand and Apple, for perhaps the first time with an iPhone, were actually ready to meet that demand. They launched the new phone into more markets and channels than ever before and managed to reduce delays in ordering the device (compared with severely restrained supply of previous iPhones). I would suggest that Apple spent the 18 months between the 4 and 4S doing a LOT of supply chain building to meet iPhone demand (and they STILL get the media-tastic queues at Apple stores to get the phones despite the ramp up in supply!)

The 4S was going to have a bumper launch whatever happened, but the other key part of the puzzle is that it was launched the day before Steve Jobs died.

The traditional disappointment about a new Apple product and perpetual sniping about the 4S only had one day to take hold before everything pretty much stopped to respect the death of Steve. This was obviously a genuinely sad moment for everyone that was involved in the industry, or used technology, and the anecdotes and praise flowed for many weeks after his death.

Zeitgeist

I can’t say for sure, but it felt at the time like the level of main-stream appreciation for Jobs’ achievements (and the just launched iPhone) was never higher.

This grasping of the Zeitgeist alongside the significant supply chain improvements sustained a near launch-weekend pace over an entire quarter (despite Apple respecting Jobs’ passing by not fully marketing the device for several days after his death).

But then the genie was out of the bottle.

The iBubble

When the holiday quarter results were released (in Jan 2012), they were basically misread as a massive shift towards Apple dominating the smartphone market, with more exceptional growth to come…

Awash with cash and desperate for a good return, all those institutional investors and flighty hedge-funds joined the Apple party for 6 crazy months. Analysts who seemed only able to join the last 2 dots on a chart said Apple was destined for $1000/share $1300… PILE in EVERYONE.

Then the fever suddenly ended with the launch of the iPhone 5. (The best phone Apple have ever released and so much better than the 4S that it’s almost embarrassing!)

Why did the market stop then? Who knows! The iPhone 5 is an outstanding product and sold better than the 4S. But I believe it was just the end of a mini bubble based on a mis-reading of Apple’s past performance.

Apple had more or less perfected their supply chain with the 4S. (It may not actually be possible to ramp up and supply more top-range high technology products than Apple has managed! What other market has a premium product that outsells every other single model?). As a creature of habit, Apple usually looks to get something as good as it can be before making small iterative improvements (until the next major changes are needed). They did it with products and then they did it with supply chains!

Just as they had significantly improved their supply, a one off event happened.

No one expected the appreciation and love that was shown towards Apple after the passing of Steve Jobs would push that 4S launch quarter far beyond what even Apple had prepared for. The success of the 4S launch quarter took everyone by surprise and to keep up that level of growth (that a deluded Wall St. now expected) Apple had to pull out every imaginable stop to match the 2011 holiday sales. Apple achieved this but it took an entire new line-up of products.

The fact Apple are not aggressively increasing the iPhone’s addressable market shows they aren’t too bothered about maximising iPhone sales… just yet. It looks like they are happy to sell to the markets they have (with China and the US being THE focus), take the profits and build the ecosystem. There will be no race to the bottom for market share until they are ready (and perhaps never, as the carriers make the phone market nothing like an iPod or PC market).

So that’s the Apple bubble. A perfection of supply to meet a huge demand, backed with an outpouring of appreciation after Steve Jobs died. No crazier an explanation than many other theories!

You must be logged in to post a comment.